- #Vat 201 form download sars manual#

- #Vat 201 form download sars registration#

- #Vat 201 form download sars code#

Material may not be published or reproduced in any form without prior written permission. To help us continue for another 35 future years with the same proud values, please consider taking out a subscription. vendor is obliged to furnish the Receiver of Revenue with a VAT 201 return which must. Post questions on the site for independent and researched information. It describes the four major forms of business organisations - sole. The vendor must use this number when making VAT payments to Sars.įor this reason it is advisable not to make copies of the VAT201 return.Īs noted above, it is unclear how the electronic form will be signed.

#Vat 201 form download sars manual#

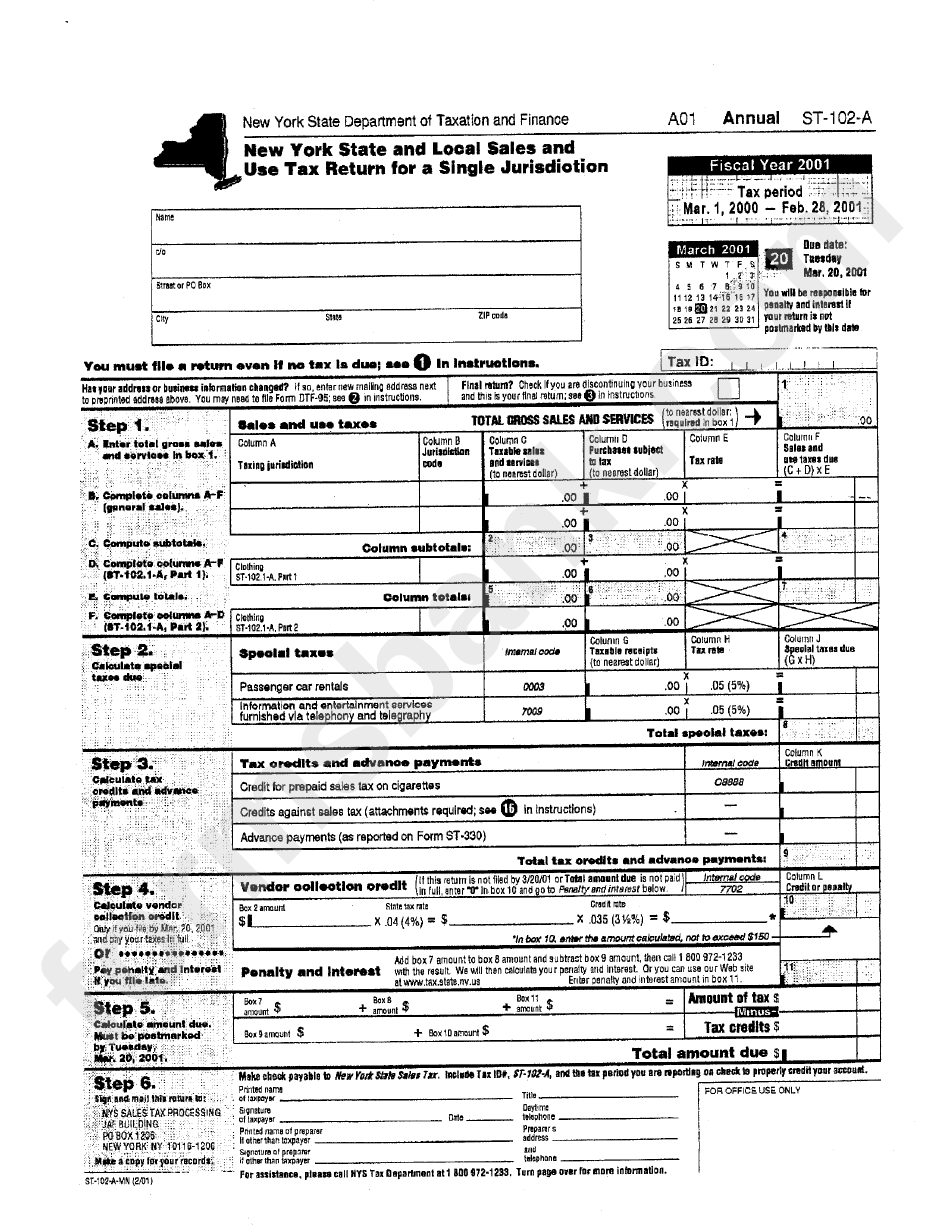

Note that copies of the VAT201 forms that are printed from eFiling and used for manual submission will be unacceptable. In a letter to VAT vendors, it said that 'vendors need to note that from 11 April 2011, all VAT submissions are required to be on the new VAT 201 form,including any submissions for periods prior to March 2011. The declarations will be displayed as follows: Issued Saved In Error. for South African VAT must be done by downloading a copy of the VAT101 form. Click on the declaration that must be submitted. The South African Revenue Service (SARS) was one of the international. Step 1 Select the relevant vendor declaration under Returns Issued from the side menu.

#Vat 201 form download sars registration#

VAT102 - Application for separate registration VAT - External form.

#Vat 201 form download sars code#

Where vendors are on e-filing, the e-filing forms will automatically be updated to reflect the additional lines and Customs Code number field. We will have to see how the new VAT201 form intends to include these additional fields.Ī number of the fields listed below are already required to be filled in and included in the current VAT201 form.Īny vendor who fails to request the new VAT201 form and wishes to submit and make payment electronically will be in default of their VAT obligations and penalties and interest will be imposed. SARS introduced several changes to the value-added tax (VAT) vendor declaration form on 11 April 2011 in its bid to 'modernise. The following steps must be completed in order to request the VAT201 Declaration. According to SARS, the VAT 201 forms posted to taxpayers will from now on be the updated forms. It is unclear, for example, how the declarant will sign the electronic form. The changes do not only apply to the electronic VAT201 forms, but manually submitted forms as well. This includes any submissions for periods prior to March 2011. eFiling user guide for Value-Added Tax 3 Step 2 Once logged into eFiling, select Organisation Tax Types from the side menu options under ORGANISATION.

If you wish to cancel a subscription, you can visit Member Area - My Tickets and Subscriptions, where you can exercise the option to cancel. Charges fluctuate depending on the length and complexity of the video.Į-mails will be sent to you 10 days before as a warning that its about to auto renew.

0 kommentar(er)

0 kommentar(er)